Autumn Budget 2023: A summary of the changes

Nov 23, 2023 2:44:33 PM

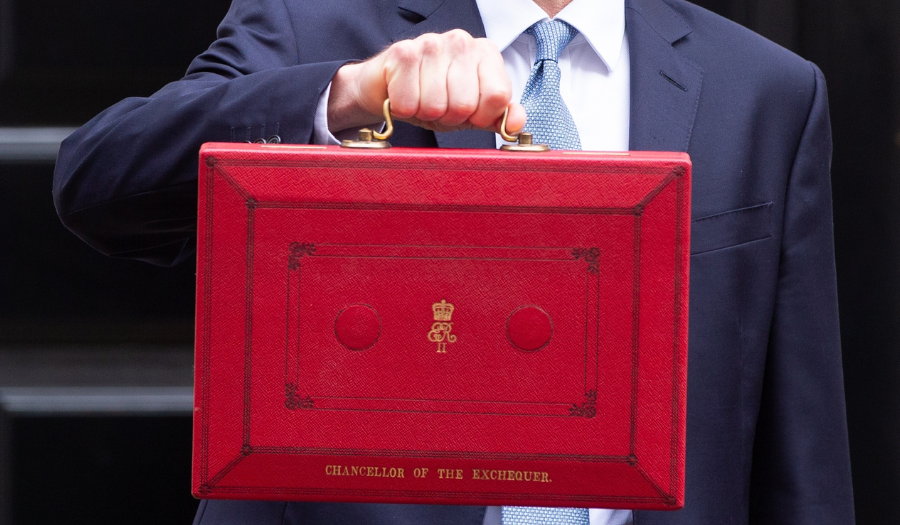

After the eventful autumn mini budgets of last year, 2023’s Autumn Statement has been highly anticipated. The government’s Autumn Statement was delivered by Chancellor Jeremy Hunt on Wednesday 22 November and included a raft of changes to taxation, business rates, and pensions.

Mr Hunt called his plan “an Autumn Statement for Growth”, filled with “measures to make work pay”. It focused heavily on measures to support British business and incentivise the unemployed population to return to work.

Here is a summary of the changes and what they might mean for you.

Inheritance Tax

Following much speculation and party pressure over cutting the rate of Inheritance Tax (IHT), Mr Hunt concluded his Statement without any mention of it whatsoever. That means that for now, IHT remains at 40%.

IHT is paid on estates that exceed the value of the Nil Rate Band (NRB), also known as the IHT threshold; this is currently set at £325,000 per person. If the first spouse/civil partner to pass away has passed everything to their partner, their full £325,000 NRB can be used upon the second death. Additional allowances may also be available, including the Residence Nil Rate Band and Business & Agricultural Relief.

Over the past decade, the number of families who fall into the allowance bracket has risen. In 2020-21, there were 27,000 deaths that resulted in an IHT charge, up from just 15,000 in 2010.

We will be closely watching the Spring Budget for any reforms to the death duty.

Pensions

Despite speculation, Mr Hunt has announced that the government will be honouring the pensions triple lock. The triple lock protection was introduced in 2010 to guarantee that the State Pension would rise in line with wage growth and inflation.

This means that April 2024’s projected growth figure stands at 8.5%. In real terms, this means a rise of £902 over the year.

Mr Hunt also announced that he will open a consultation on the possibility of requiring employers to pay pension contributions into an employee’s existing pension pot – the Chancellor called this “one pension pot for life”, stating that this reform could help to unlock “an extra £1,000 a year in retirement for an average earner saving from [the age of] 18”.

Business Reliefs

The Chancellor dedicated a large portion of his Autumn Statement to measures for business growth, with an extra focus on small business.

Among these measures were business rate relief extensions and freezes on alcohol duty to support the hospitality industry.

Full expensing has been made permanent, which the Chancellor called “the biggest business tax cut in modern British history.” This means that for every £1 that a business invests in IT, machinery, and equipment, they can claim back 25p in corporation tax.

Wages & Workers

Mr Hunt confirmed in the Statement that the UK’s National Living Wage will rise from £10.42 per hour to at least £11.44 per hour. This announcement was initially made at the Tory Party conference in October, with the exact figure confirmed by Mr Hunt in the statement on Wednesday. That’s a rise of 9.8%, which the Chancellor says is “the largest cash increase” in the National Living Wage.

This is welcome news for the nearly two million workers who will benefit from the rise. For a full-time worker, it is worth up to £1,800.

National Insurance

One of the major announcements in Mr Hunt’s Autumn Statement was a reform to National Insurance rates. In addition to the changes to Class 2 and 4 rates, the main rate of employee National Insurance has been reduced by two percentage points, effective from 6th January 2024.

This puts the rate of National Insurance at 10%, down from 12%. Mr Hunt stated that change will help 27 million people – in real terms, this means a £450 per year saving for a person on an average salary of £35,000.

Mr Hunt also announced total reform of how self-employed individuals pay National Insurance (NI):

-

Compulsory Class 2 National Insurance has been abolished altogether, saving the average self-employed person £192 per year. This removes the compulsory £3.45 weekly charge, simplifying and cutting tax for nearly 2 million self-employed people.

-

In addition, those who qualify for Class 4 NI rates in the £12,570 to £50,270 bracket have had the rate cut from 9% to 8%. Mr Hunt says that, taken together, these changes will save around £350 per year from April 2024.

What next?

It is hoped that the changes will help the UK enter a period of growth now that inflation has significantly subsided. The latest figures from the Office for Budget Responsibility (OBR) indicate that the economy is expected to grow by 0.6% this year, with inflation falling to 2.8% by the end of 2024. After its peak of 11% in 2022, this is encouraging news.

Title Research is an expert in genealogical research and asset repatriation. We have excellent success rates for supporting legal professionals with overseas assets during estate administration and tracing thousands of missing people every year. If you would like to discuss how Title Research can help support you during different stages of the estate administration timeline, call our Client Services Team on 0345 87 27 600 or fill in the form below.